Employee health and well-being are fundamental to organizational success. When employers understand generational preferences, attitudes, and utilization around preventive care, they can more effectively design preventive care strategies and programs that support the needs of their diverse workforce.

So why are employees of all generations skipping their preventive care when preventive exams help detect or prevent serious diseases and medical conditions before they become serious and costly? According to the 2024 AFLAC Wellness Matters Survey,

- U.S. adults say logistics and “feeling healthy” are why they skip routine wellness visits and screenings.

- 77% of Americans admit to putting off an important health checkup.

- Millennials admit to avoiding important health screenings at higher rates, with 84% admitting to delaying health and wellness screenings beyond the recommended time frame. Meanwhile, 67% primarily use urgent care or the emergency room for their healthcare needs.

- 82% of Gen Z admit to avoiding important health screenings, and 70% of Gen Z use urgent care or the emergency room for their healthcare needs.

Do you know:

- Among those survey respondents diagnosed with cancer from the 2024 AFLAC Wellness Matters Survey, 56% say they found out as the result of a regularly scheduled cancer screening or routine exam.

- An estimated 72 million women in the United States have skipped or delayed a recommended health screening, according to a poll conducted by Gallup for medical technology company Hologic.

- 90% of women acknowledged the importance of regular health screenings, but more than 40% skipped or delayed a test.

- The survey found that women have trouble prioritizing their health, with over 60% of women responding that it is hard to do so.

- The numbers are exciting among younger women; 74% of women in Generation Z and 70% of millennials said it was hard to prioritize their health, compared with 52% of baby boomers and 39% of the Silent Generation.

- 41% of U.S. women delayed or skipped screenings for breast cancer, 35% for cervical cancer, and 33% for colorectal cancers.

- People of all ages in the workforce should consider their health a vital factor in their ability to save for retirement. Why? Because healthcare is expensive and costs continue to increase as health risks increase. Consider the following:

- The money needed in retirement to pay for healthcare

- In its 23rd annual Retiree Health Care Cost Estimate, Fidelity Investments revealed that a 65-year-old retiring this year can expect to spend an average of $165,000 in health care and medical expenses throughout retirement.

- Since most generations won’t be of retirement age in 2024, they should still use the $315,000 estimate per couple, adjusted for inflation, for planning purposes for future retirement at age 65.

- The impact of chronic health conditions in retirement can be daunting if not addressed early.

- The money needed in retirement to pay for healthcare

Knowledge is power

Employees can’t manage what they don’t measure, so knowing their numbers from their annual screening and understanding their risk is critical to preventing cardiovascular disease, diabetes, and cancer, among other diseases.

Why it matters

- Ten modifiable health risk factors are linked to over one-fifth of employer-employee healthcare spending. (10 Modifiable Health Risks)

- Direct healthcare costs for individuals with chronic diseases amount to an average of $6,032 annually. This number is five times greater than their counterparts without chronic disease. (Financial Strain of Chronic Disease)

- Skipping preventive care can have dire health and financial consequences. As a result, many employees will need more money in retirement to pay for their out-of-pocket healthcare expenses.

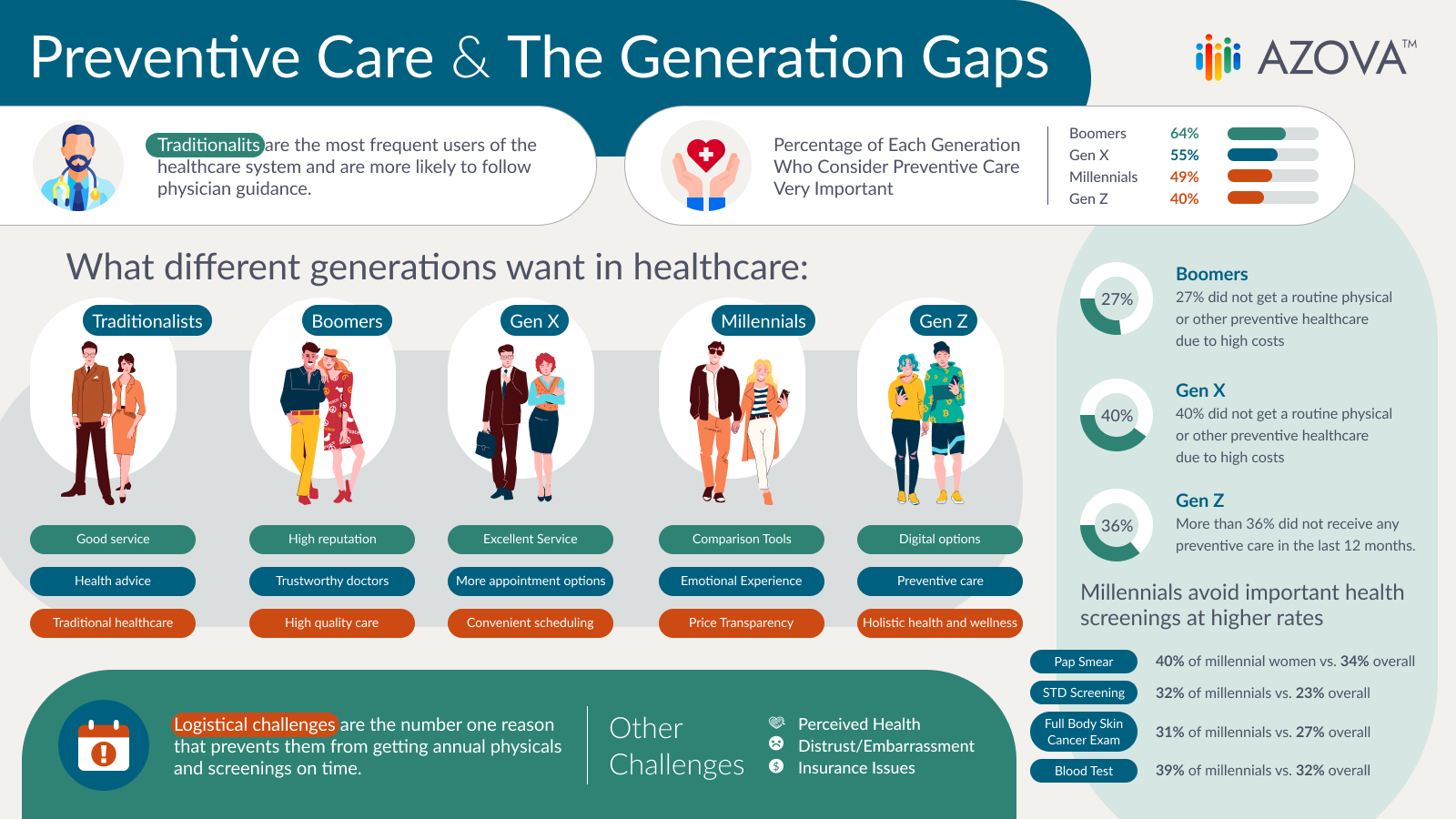

- As outlined in the chart below, each generation in the workforce has different attitudes towards preventive health and other reasons preventing them from getting checkups and screenings on time. Understanding these generational preferences and differences will go a long way toward employee wellness.

What can employers do to encourage their multigenerational workforce to get preventive care?

- Foster a culture of health. Employees are more likely to get their preventive care if their company leaders endorse it and they see other employees participating. When employees are encouraged by their employer to prioritize their health, they feel supported and empowered.

- Understand the generational preferences and what each generation values from a preventive care perspective and target communication accordingly.

- Help employees see the “health/savings” correlation by incorporating the following into communication:

- Health Investment: Viewing preventive care and healthy lifestyle choices as investments in their future can lead to fewer medical issues and lower healthcare costs over time, meaning more money can be directed towards retirement savings rather than medical bills.

- Consistency in Earnings: Maintaining good health helps ensure a consistent work performance and fewer sick days, which can contribute to steady earnings and career progression. This stability is crucial for building a robust retirement fund.

- Longevity and Quality of Life: Staying healthy can lead to a longer, more active life, allowing for an extended working period if desired, increasing the amount saved for retirement, and enhancing the quality of life during retirement years.

- Cost Management: Healthy individuals often face lower insurance premiums and out-of-pocket medical expenses. The savings from reduced healthcare costs can be reallocated to retirement accounts, maximizing the growth of their nest egg.

- Incentivize the use of preventive care services at annual enrollment and provide a time parameter for doing this so that early risk stratification occurs and employees get to the right resources at the right time.

How AZOVA helps

At AZOVA, we remove logistics barriers and bring preventive care to employees’ homes.

The AZOVA HEALTHBOX Virtual Preventive Exam reimagines the annual exam to give employees a convenient, comprehensive health assessment from the comfort of their own homes. It also provides employers with an aggregate population-level view of their employees’ overall health risks that is actionable before large claims hit and HIPAA-compliant.

Early detection of these risks through preventive exams is transformative and a “win-win” for employers, employees, and the entire healthcare ecosystem downstream.